Attention GenX'ers and Boomer Parents:

Avoid the 7 Hidden Estate Dangers That Undermine Family Finances — with a $27 Fix

50% of Americans will be affected by 1 or more of these issues:

One missed detail — like not knowing to add a POD to your bank account — can leave your family in a six-month probate nightmare.

DocuPlan gives you a 90 minute step-by-step guide to avoid potential problems.

It's is a fast fix designed specifically for procrastinators who need a simple guide.

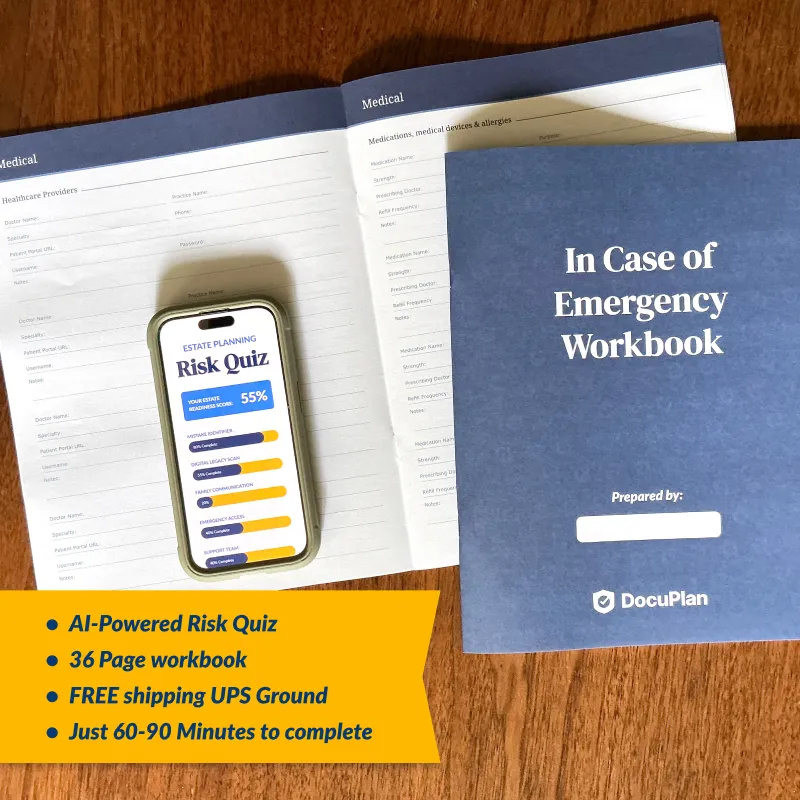

DocuPlan' $27 AI Risk Quiz and Workbook helps GenX’ers and their Boomer parents get ahead of estate dangers in under 90 minutes.

It's a simple fix perfect for the "I'll deal with it later" crowd that uncovers your personal risks in minutes and mails you a fillable workbook your family can grab in an emergency.

Included in the $27 is DocuPlan's AI Risk Quiz. It saves you $1,000’s in lawyer bills by uncovering gaps (specific to your situation) you can address before paying $300/hour for the expertise you really need.

Why families trust DocuPlan

3 disasters that happen when families are unprepared:

Disaster #1:

The scavenger hunt from hell

Your family will spend weeks going through every drawer, every email, every piece of paper trying to piece together your financial life.

They'll find old statements from closed accounts, passwords that don't work, and important documents mixed in with junk mail.

Meanwhile, bills are piling up, accounts are getting frozen, and everyone's getting frustrated with each other.

Disaster #2:

The family civil war

Without clear instructions, your family will start making assumptions about what you "would have wanted." Your daughter thinks you meant for her to get the house. Your son thinks he was supposed to handle the finances. Your spouse doesn't know who to listen to.

What starts as confusion turns into accusations, resentment, and sometimes permanent family rifts.

Disaster #3:

The money drain

Because no one knows what accounts exist or how to access them, your family pays lawyers $300/hour to play detective. They'll pay penalties on missed bills, lose out on time-sensitive benefits, and watch your estate shrink while they're trying to figure out what you owned.

The money you worked your whole life to save gets eaten up by totally preventable costs.

The kicker?

This work gets done either way.

The question is whether you want your family doing it while they're grieving, or handle it now (in a couple of hours) and spare them additional grief.

Former client Anne S. said...

“The lawyer billed $1,200 just to find what was missing. DocuPlan could have caught 80% of those problems for $27.”

Here's what we figured out:

Most people never get their affairs in order because it feels too time consuming, too complicated, or too expensive. So we created the absolute minimum your family needs to avoid disaster.

DocuPlan isn't everything. It's not a complete estate plan. It's not going to replace a lawyer for complex situations.

But here's what it will do:

It will take you from "my family would be completely lost" to "my family has what they need to get started" in about 90 minutes of your time.

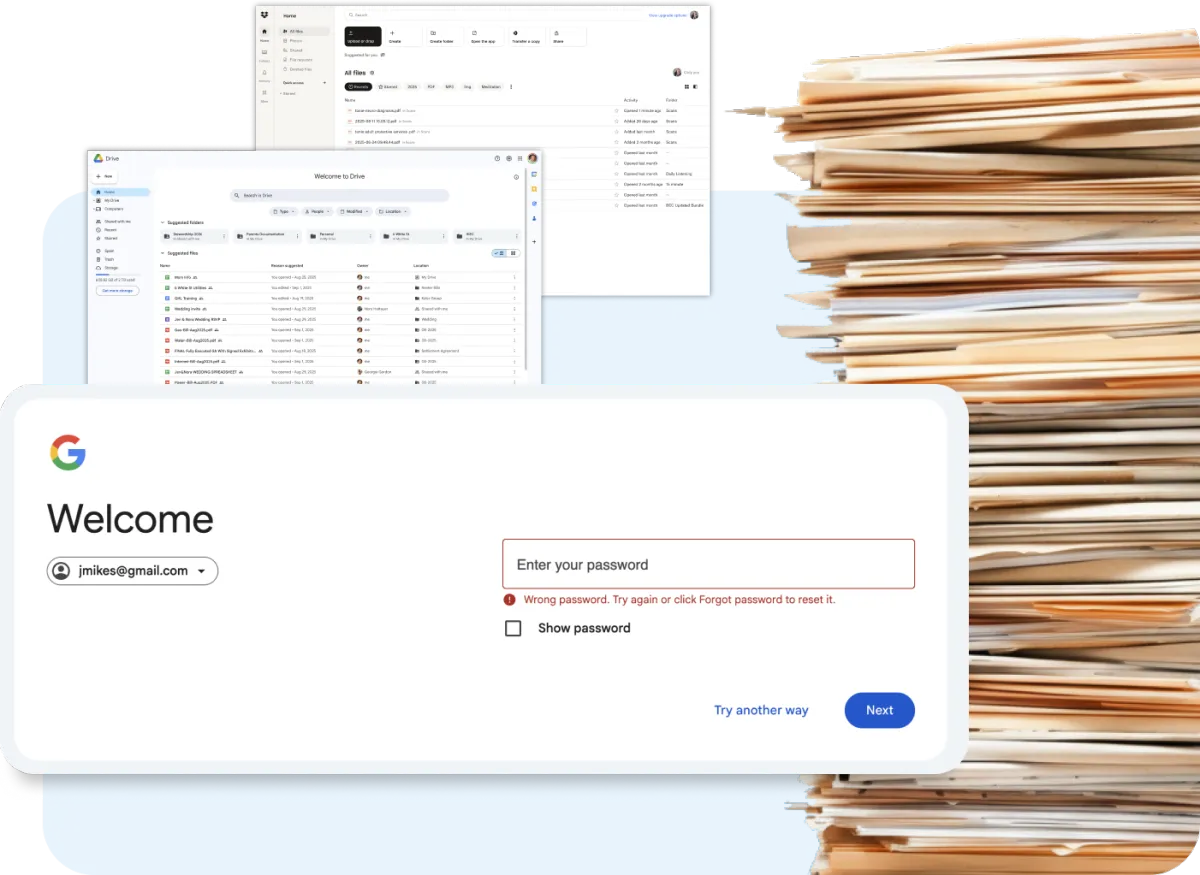

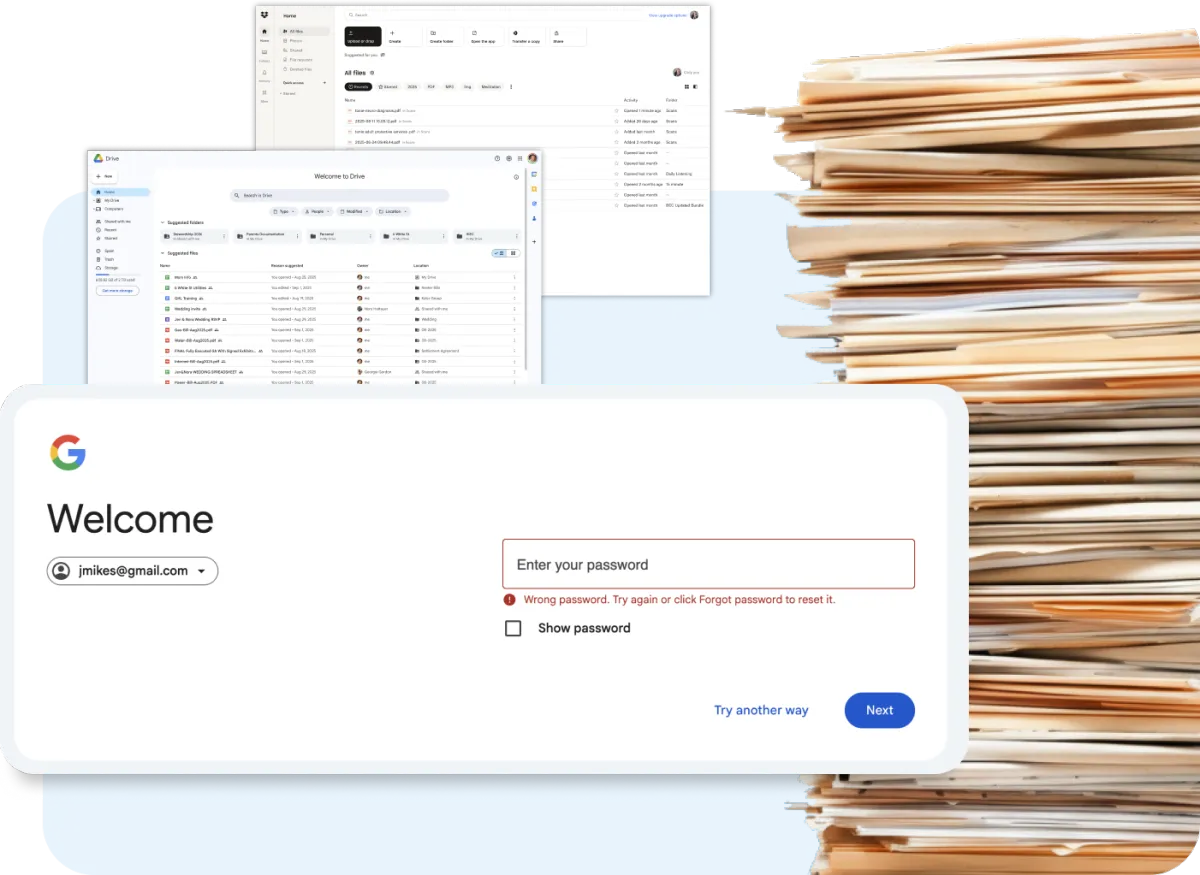

Before DocuPlan:

No centralized file with everything a loved one would need if something happened.

Google Drive is mess and not that searchable because files aren't properly named and filed.

Passwords are "sort of" stored in the browser on your phone, an address book, or worse, in your head. 😬

Paper files aren't in one place which means finding something in case of emergency is as frustrating as the emergency itself.

After DocuPlan:

ONE Document with Answers - in just a couple of hours gain peace and clarity, with documented passwords, accounts, logins, documents, and key contacts so family has info at their fingertips!

Easy Fill in the Blank - The “In Case of Emergency” Workbook isn't a weeks long adventure to complete. We're getting the ESSENTIALS documented that family will be so grateful you wrote down.

Clarity on Next Steps — in just 10 minutes, our AI-Powered Risk Quiz finds your specific hidden gaps and ranks them by urgency.

Why this works when everthing else fails:

It's designed for procrastinators. We know you've been putting this off. That's why we made it impossible to overcomplicate. It's a step by step guide you can't mess up.

The Risk Quiz takes the thinking out of it. No more wondering "What am I missing?" Our system tells you exactly what to write down and where.

Your family can actually use it. We didn't create another folder that sits in a drawer. This is designed so that when your family is stressed and emotional, they can follow simple steps.

It's the bridge, not the destination. Get basic protection now. If you want more comprehensive planning later, you can always upgrade to full DocuPlan Pro. But don't let "perfect" be the enemy of "protected."

"If I died tomorrow, my family would be lost."

"I don't trust online security with my logins and personal IDs."

"I'm afraid family is going to argue if I don't spell out my wishes."

"I know I need to do this but just don't make the time."

Why Not Just Hire a Lawyer?

You could pay an estate lawyer $300 an hour to identify these problems for you.

And they will.

The first 4–5 hours of your bill won’t be for fixing anything. It’ll be for discovery — digging through accounts, asking the right questions, and uncovering gaps. That’s $1,200–$1,500 just to figure out where you stand.

Or… you could walk into their office already prepared.

That’s exactly what DocuPlan is built for. It combines:

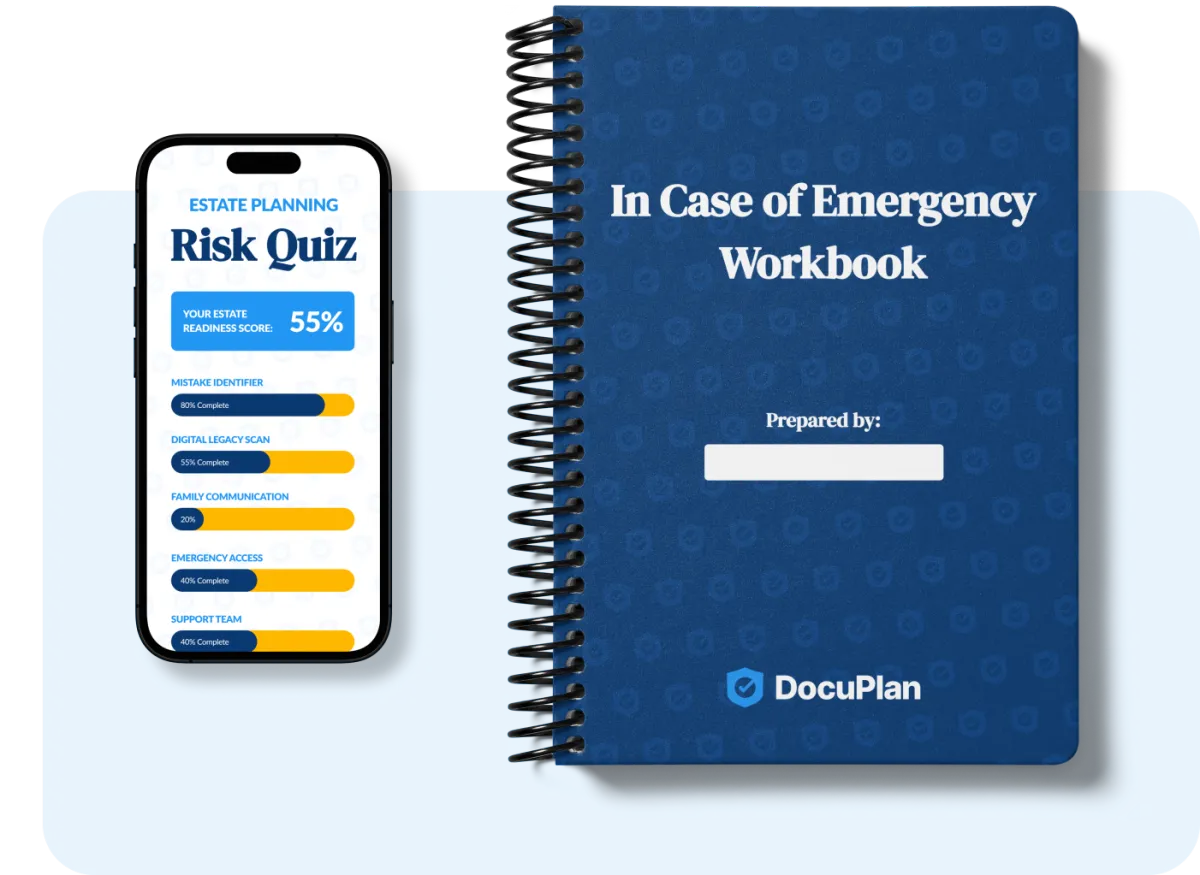

An AI-Powered Risk Quiz — in just 10 minutes, it finds your hidden gaps and ranks them by urgency.

A personalized risk report showing your hidden gaps.

A Printed “In Case of Emergency” Workbook — shipped to your door, so you can record accounts, logins, documents, and key contacts in one place your family can actually use.

With those in hand, you’re no longer paying a lawyer for 5 hours of detective work. You’re paying them for 1 hour of focused solutions.

Same lawyer. Same expertise.

Just a fraction of the cost — because you already did the smart prep work.

"We had no idea Mom had an investment account tied to her teacher retirement. So glad we got DocuPlan to ask all the right questions."

Jennifer S.

Daughter & executor

"If I died tomorrow, my family would be lost."

"I don't trust online security with my logins and personal IDs."

"I'm afraid family is going to argue if I don't spell out my wishes."

"I know I need to do this but just don't make the time."

About DocuPlan

Hi there, Jen from DocuPlan here. When I founded DocuPlan five years ago, I combined two decades of research and data security experience from banking and healthcare to solve the administrative chaos families face after a death.

Our mission is simple: treat your family like our own by providing tools that bring clarity and peace of mind during an already difficult time.

Here's everything that's included

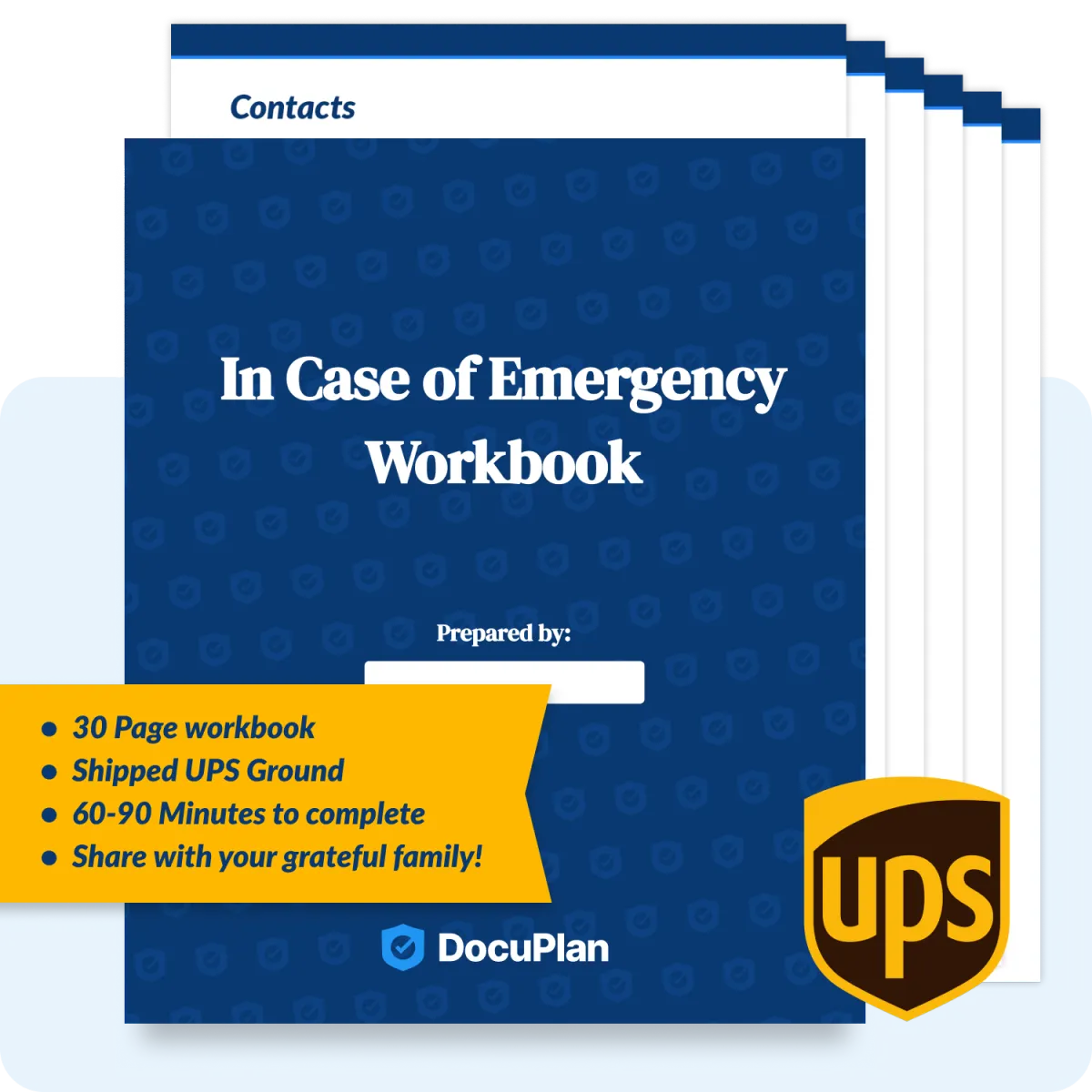

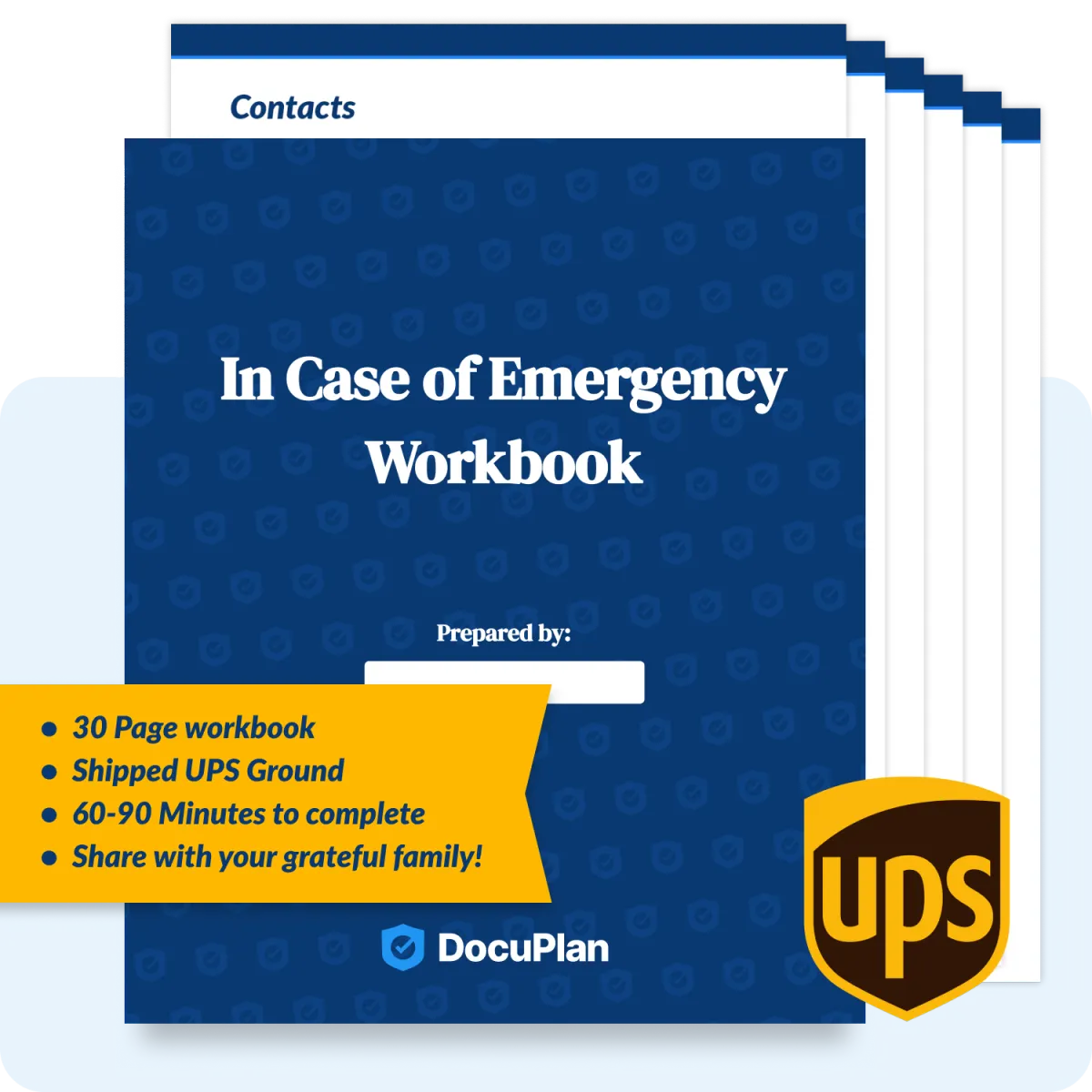

$27 includes free shipping within the continental US. All orders ship UPS Ground within 24 hours.

The AI Estate Risk Assessment ($97 value)

What it is: A smart questionnaire that analyzes your specific situation and tells you exactly which gaps could cause your family the most problems.

Why it's valuable: Instead of guessing what you need to document, you get a personalized report of your biggest vulnerabilities. Most people miss 3-4 critical areas that could cost their families thousands.

What you get: Custom risk score + prioritized action list for your situation.

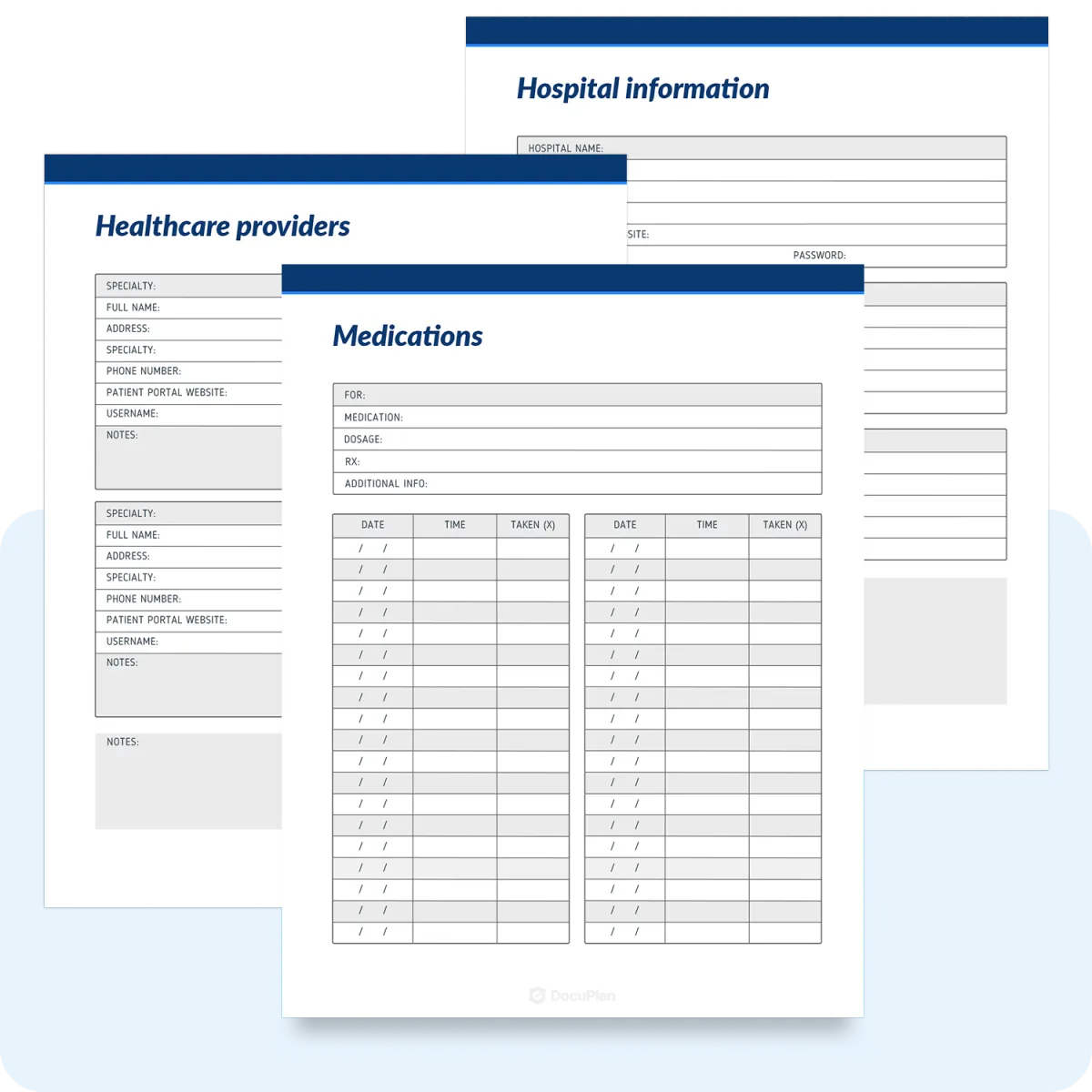

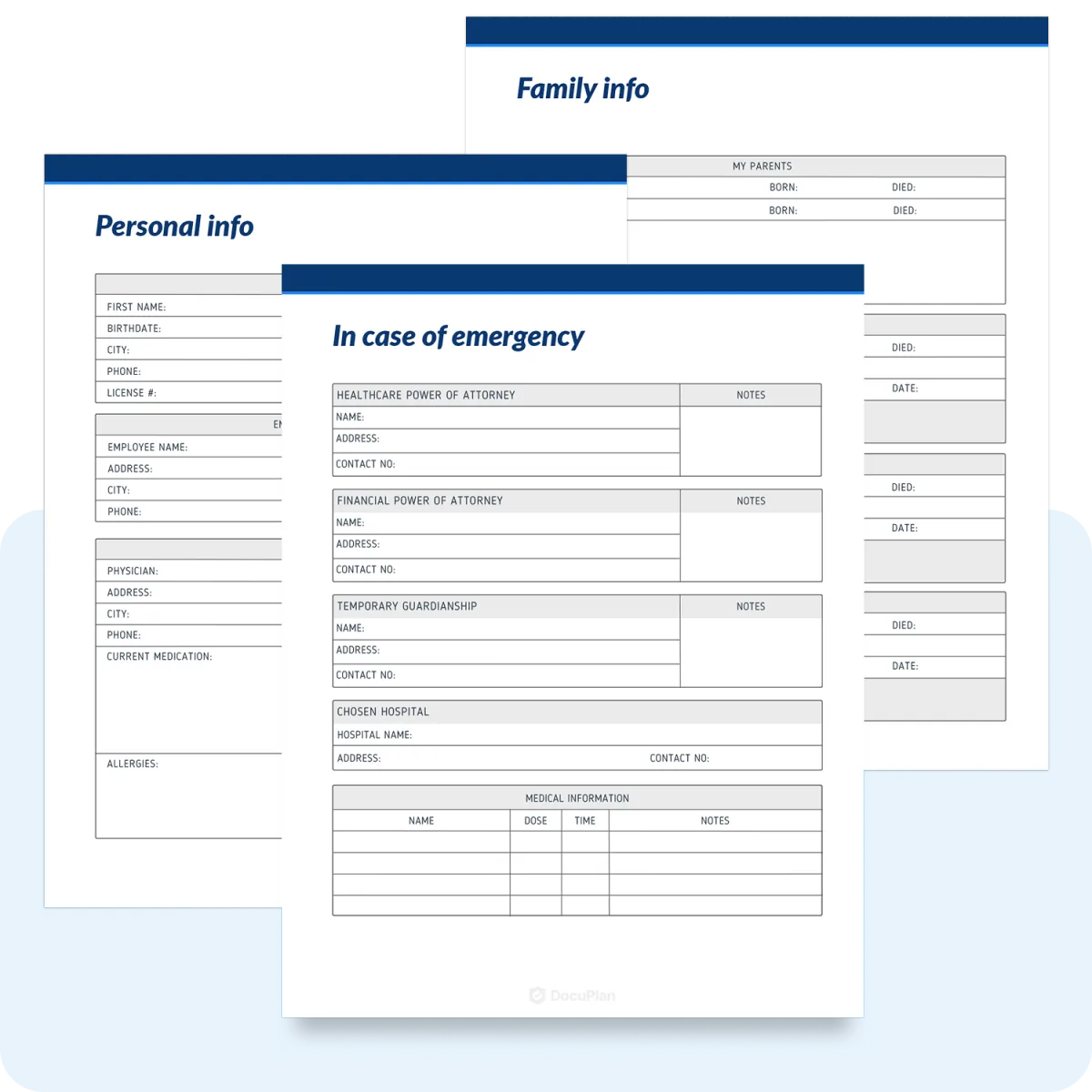

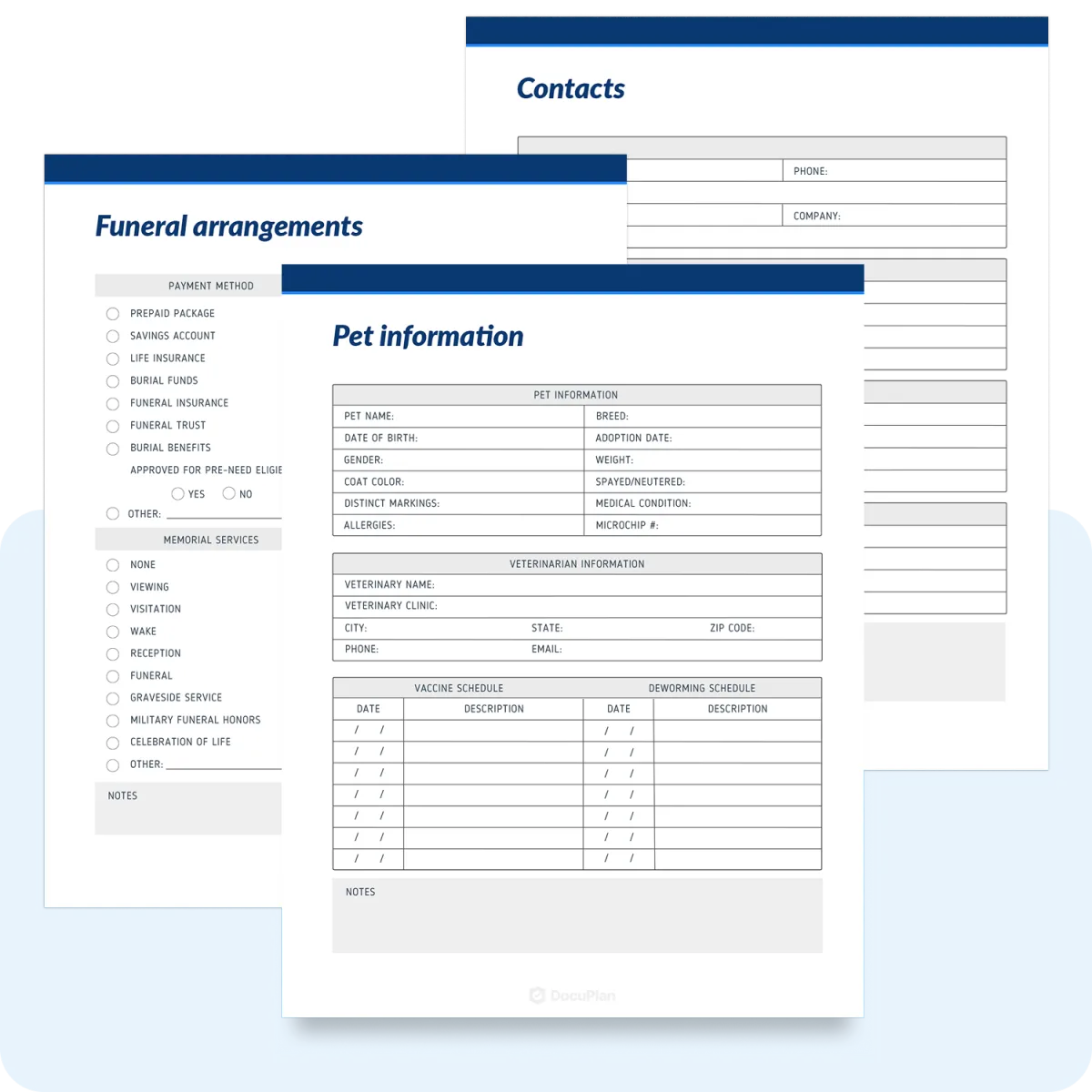

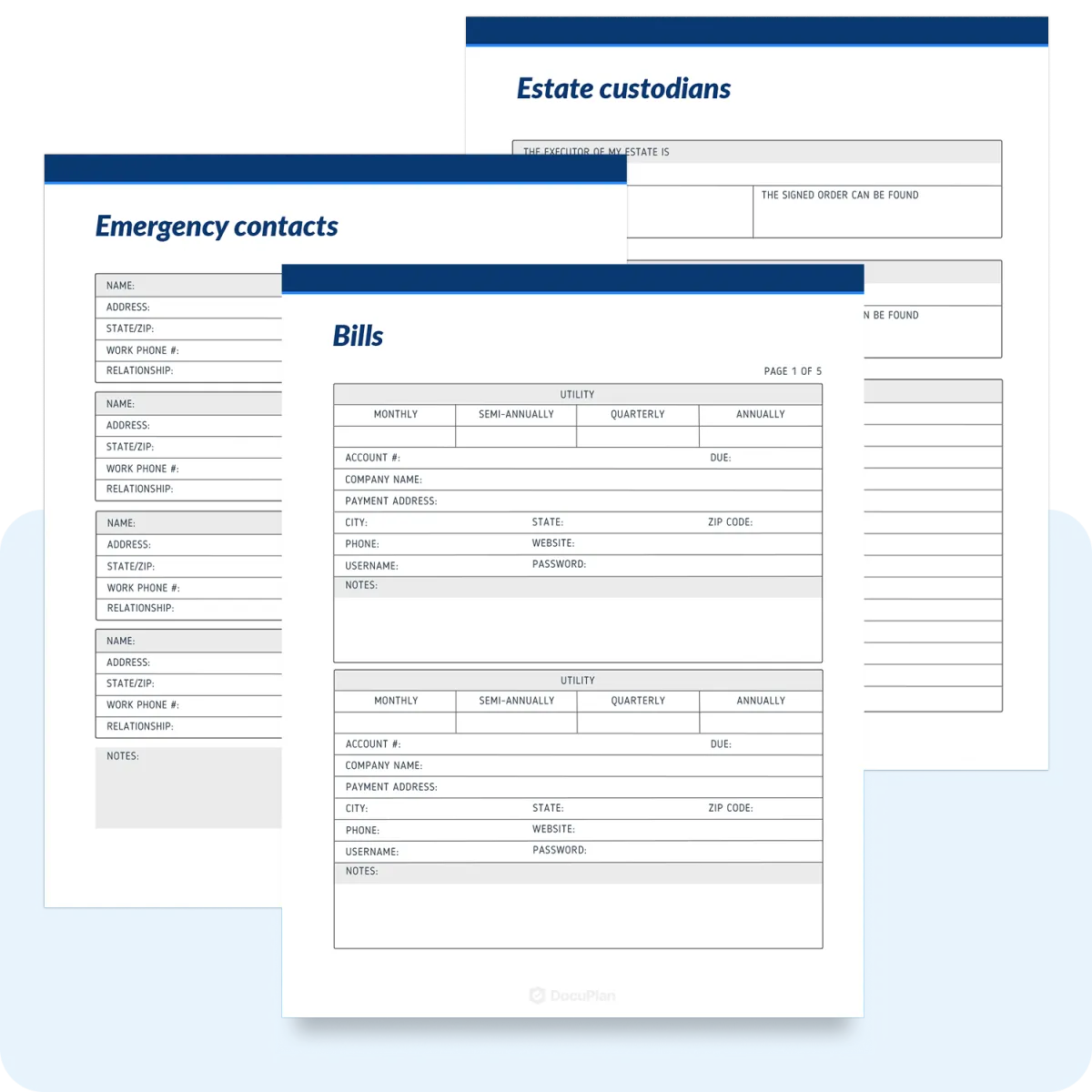

The Complete Emergency Preparedness Workbook ($67 value)

What it is: A professionally designed, printed workbook mailed directly to your door with fill-in-the-blank pages for all the essential information your family needs.

Why it's valuable: No more wondering "what should I write down?" Every page tells you exactly what information goes where. Plus it's printed and bound - not a flimsy printout that gets lost.

What you get: 30-page workbook covering passwords, accounts, contacts, wishes, and emergency instructions.

Priority Shipping & Handling ($12 value)

What it is: We ship your workbook within 24 hours so you can get this done this week, not "someday."

Why it's valuable: The whole point is to stop procrastinating. Fast shipping means you can't use "I'm waiting for it to arrive" as an excuse to delay.

What you get: Tracked shipping directly to your mailbox.

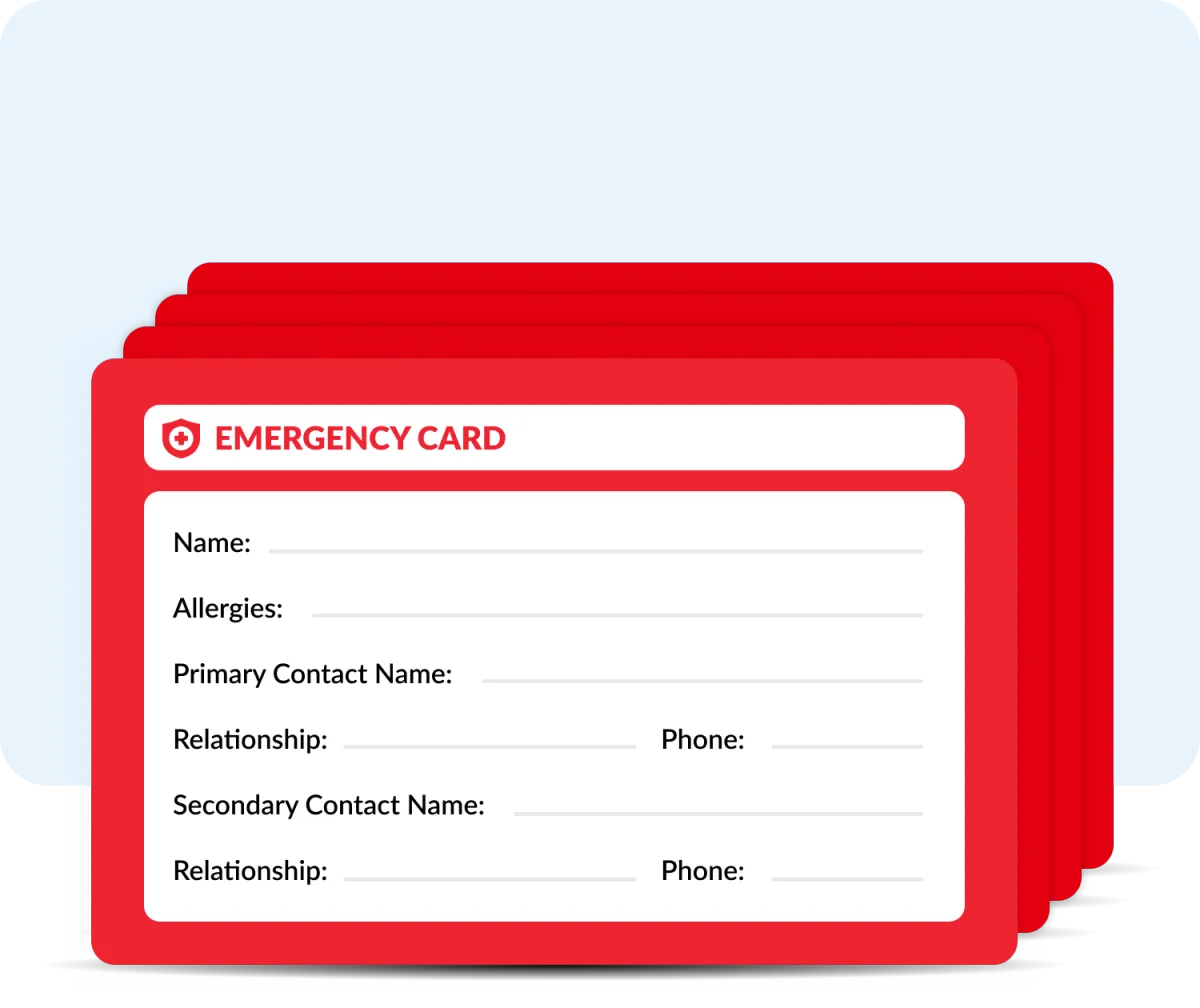

PLUS: Action-Taker Bonus

Grab DocuPlan within the next hour and get 4 indestructible emergency cards for your wallet.

4 Emergency Contact Cards ($27 value)

What it is: If you phone is lost or damaged these wallet-sized cards provide key info for first responders or family in case of emergency.

Why it's valuable: Even if they can't find your workbook right away, this card in your wallet gives them the most critical information instantly.

What you get: 4 emergency cards printed on hefty card stock, plus a PDF template if you need to print more.

Your total value: $203

Your investment today: Just $27

Order Form

$27 includes free shipping within the continental US. All orders ship UPS Ground within 24 hours.

🏆 Satisfaction Guarantee

If you're unsatisfied with your purchase for any reason, email us for a full refund.

🔐 Security & Privacy Policy

All personal information you submit is encrypted and secure. We will not share or trade online information that you provide us (including e-mail addresses).

💻 Customer Support

Team DocuPlan is here to support you every step of the way. Questions? Email us at [email protected].

Why smart families choose DocuPlan's AI over ChatGPT for estate planning questions

The only estate planning AI built on hand-verified knowledge by a certified estate planner—plus your private family information stays private, never fed back into ChatGPT's training system

Verified Estate Knowledge vs. Internet Guesswork ChatGPT pulls from random online sources. DocuPlan's knowledge base was hand-curated and verified by Certified Estate Planner Jen Gordon using 20+ years of research expertise.

Complete Privacy Protection Your sensitive family and financial information stays completely private with DocuPlan—unlike ChatGPT, which uses conversations to improve its system.

Estate-Specific Intelligence ChatGPT gives general advice for everything. DocuPlan was purpose-built exclusively for estate planning using verified legal procedures and real case studies.

Systematic Approach vs. Random Answers ChatGPT responds to individual questions. DocuPlan conducts a comprehensive interview to deliver your complete, prioritized action plan.

"If I died tomorrow, my family would be lost."

"I don't trust online security with my logins and personal IDs."

"I'm afraid family is going to argue if I don't spell out my wishes."

"I know I need to do this but just don't make the time."

Frequently Asked Questions

About DocuPlan

What exactly do I get for $27?

You get three main components: (1) An AI-powered risk quiz that identifies your specific estate vulnerabilities, (2) A professionally printed 30-page "In Case of Emergency" workbook mailed to your door, and (3) Four emergency wallet cards as a bonus. Everything ships within 24 hours via UPS Ground, at no additional cost.

Title or Question

Describe the item or answer the question so that site visitors who are interested get more information. You can emphasize this text with bullets, italics or bold, and add links.

Is this a complete estate plan?

No, and we're upfront about that. DocuPlan Lite is designed as the essential foundation that gets you from "my family would be completely lost" to "my family has what they need to get started." For complex situations, you'll still need an attorney, but you'll walk into their office prepared instead of paying them $300/hour for discovery work.

How is this different from just writing everything down myself?

The AI risk quiz identifies gaps you likely don't know exist—most people miss 3-4 critical areas. The workbook is structured so your grieving family can actually use it when they're stressed and emotional, not just a random list of information.

How It Works

How long does the AI risk quiz take?

About 3-5 minutes. It asks specific questions about your situation and generates a personalized report ranking your risks by urgency.

How long does it take to fill out the workbook?

At most, about 90 minutes total. It's designed for the "I'll deal with it later" crowd—quick enough to actually get done, comprehensive enough to matter.

Do I have to complete it all at once?

Not at all. You can work through it in sections over several days. The workbook is organized so you can tackle one area at a time.

What if I don't have all the information handy?

The workbook shows you exactly what to gather and where to find it. You can fill in sections as you locate information. It's better to start with what you have than to wait until you have everything.

Security & Privacy

Is my personal information safe?

Yes. All information stored in the AI Risk Quiz is encrypted and secure. Unlike ChatGPT, your data stays completely private and is never used to train AI systems. We don't share or trade your information with anyone.

What happens to my data after I complete the quiz?

Your information is used solely to generate your personalized risk report. We maintain strict privacy standards that includes a 30-day deletion policy and data is not used to train models.

Should I include actual passwords in the workbook?

The workbook provides secure methods for recording password information that your family can access but that don't expose you to security risks. We include specific guidance on safe password documentation if you're prefer to not write them in the workbook.

For Different Situations

I don't have much money. Is this still worth it?

Yes. Even modest estates can create major headaches for families. The goal is preventing your family from spending weeks playing detective while dealing with grief, regardless of estate size.

I'm only in my 40s. Isn't this premature?

Consider this: if something happened tomorrow, would your family know how to access your phone, find your accounts, or contact your financial institutions? Age doesn't predict emergencies, and younger people often have more complex digital lives that are harder to untangle.

My spouse already knows everything. Do I still need this?

Two things: (1) What if something happens to both of you? (2) Knowing something exists and being able to find/access it under stress are very different things. This creates a roadmap for anyone who needs to step in.

I have a complex estate with trusts and businesses. Will this help?

DocuPlan Lite covers the fundamentals that every family needs. For complex assets, you'll need professional help, but this ensures the basics are covered and prepares you for more comprehensive planning.

Shipping & Logistics

How quickly will I receive the workbook?

All orders ship UPS Ground within 24 hours. Most customers receive their workbook within 3 business days.

Can I get a digital version instead?

The workbook is intentionally printed because it needs to be something your family can grab and use during a crisis, even if devices aren't working or accessible. If you'd like an electronic version, click the checkbox next to "Special Offer" on the order form and we'll send you the electronic version.

Comparisons & Alternatives

Why not just use a lawyer from the start?

You could, but you'll pay $300/hour for them to discover what DocuPlan identifies for $19. Most people spend $1,200-$1,500 just on discovery before any actual legal work begins. This gets you prepared so you're paying for solutions, not fact-finding.

How is this better than free online templates?

Free templates don't tell you what you're missing or prioritize what matters most. Our AI identifies your specific gaps, and the workbook is designed so your family can actually use it during an emergency, not just file it away.

What about using ChatGPT for estate planning questions?

ChatGPT pulls from random internet sources. DocuPlan's knowledge base was hand-curated by a certified estate planner with 20+ years of experience. Plus, ChatGPT uses your conversations to improve its system—your private family information stays private with DocuPlan.

After Purchase

What if I realize I need more comprehensive planning?

Perfect! You can always upgrade to DocuPlan Pro later. Think of this as the bridge, not the destination. It gives you basic protection now while you decide on more comprehensive planning.

What if my situation changes?

The workbook is designed so you can update information as needed. Major life changes (marriage, divorce, new children, significant asset changes) are good triggers to review and update your documentation.

Do I need to tell my family about this?

It's most helpful if at least one trusted person knows where to find your workbook. Consider telling them about DocuPlan when you're ready, or at minimum, note its location in the workbook itself.

Guarantee & Support

What if I'm not satisfied?

We offer a satisfaction guarantee. If DocuPlan Lite doesn't meet your expectations, click here to contact our support team.

Can I get help if I'm stuck?

Yes! Click here - our team is here to support you every step of the way. If you're looking for an accountability partner, upgrade to DocuPlan Pro.

What if I have questions the workbook doesn't address?

That's exactly when you'd want to consult with an attorney, but you'll be asking informed questions rather than starting from scratch. Many questions can also be addressed by our support team.

"If I died tomorrow, my family would be lost."

"I don't trust online security with my logins and personal IDs."

"I'm afraid family is going to argue if I don't spell out my wishes."

"I know I need to do this but just don't make the time."

This site is not a part of the Facebook website or Facebook, Inc. or the Google website or Google, LLC or Alphabet Inc., or TikTok, Inc. or ByteDance, Inc. Additionally, this website is NOT endorsed by Facebook in any way, or the Google website or Google, LLC. or Alphabet Inc. Facebook is a trademark of FACEBOOK, INC., or TikTok, Inc. or ByteDance, Inc. or any affiliated companies.