Are you a GenX child of a Boomer?

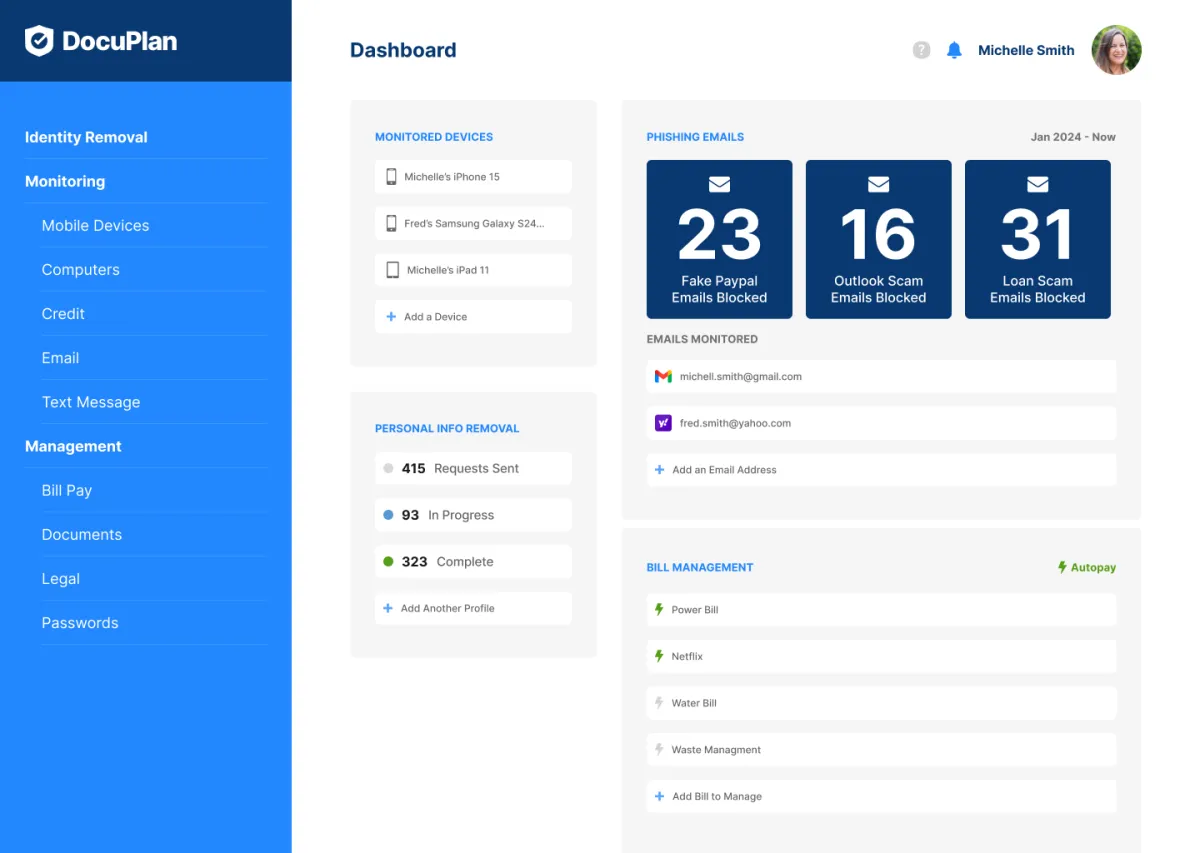

Prevent financial loss with scam protection and daily money management

We help families lock down devices to keep everyone safe:

Protect against scams by scrubbing your personal data from the web and blocking unknown calls/texts

Monitor credit activities, alerting you to credit hits and suspicious purchase attempts

Manage passwords and secure online accounts with two-step authentication

Automate financial tasks and organize important identity, financial, healthcare and insurance documents

We implement online and offline tools to keep your personal and financial data safe

Additional layer of email, text and phone call filtering, beyond built in filters

All important documentation organized in case of incapacitation or death

Daily money management portal so you always have a high level view of your finances

Fireproof physical organizer of important documents

If something were to happen to you tomorrow, would your family be prepared to manage your home, possessions, online accounts, finances, and medical or end of life wishes? We prepare both online and offline document organization for families to have peace of mind during difficult times.

Digital executor services - organization of online assets

A digital executor is a trusted individual responsible for managing your digital life after you pass away or assisting with the digital affairs of a loved one who has already passed. We ensure a seamless and secure process to carry out your wishes for how these digital assets are preserved or destroyed.

Automate ACH deposits, bill pay & tax document prep

Managing finances can be a daunting task, especially for elders, busy individuals or families juggling multiple responsibilities. We automate ACH deposits, bill pay, and tax document preparation to significantly ease this burden and ensure timely payments and no transactions are missed.

Reduce worry of phone, text and email scammers

Scrub your personal information from online databases

Don't let companies exploit your personal information. Data brokers collect your personal information and profit off it at the expense of your privacy. Let us help you take back control of your data, reduce spam, and prevent scam attacks by opting you out of their databases automatically.

Opt-out of solicitation calls & filter unknown senders

Enter and regularly verify do not call/text registries and install apps that filter unknown senders so their texts are sent to a separate folder and you don't receive notifications from them. This is similar to the Junk folder in email.

Setup filters and monitor for email scams

Our system pre-filters email for scams, beyond what the typical Gmail, Outlook or Yahoo spam filters pick up. We manually review each spam report to verify it's legitimacy. Marking these senders as spam over time cleanses the inbox and makes the process go faster over time. Depending on your needs we can set up a variety of filters that keep the inbox just to messages from friends, family and healthcare related items.

Password management and documentation of online accounts

Complete listing of all accounts and logins

It may sound grim, but how easy would it be for your relatives to find all of your online assets when you pass? One of our most valuable services is creating an inventory of all your important online accounts: financial, healthcare, business-related, email, tax, etc., along with the setup of password management.

Setup of secure management of passwords

Keeping track of passwords can be difficult for all of us. We have a variety of ways to set up password management and will customize to your needs. Our most secure system that allows family sharing is completely online, but if you and your family member prefer a paper system, that can also be accomodated.

2-step authentication setup for family members

2-step authentication can be difficult when it's hitting devices where someone may not be available to provide login codes. We set up systems that allow secure transfer of codes without waiting for family members to respond.

Set up controls for online spending

Set up alerts for large purchase attempts

Don't let companies exploit your personal information. Data brokers collect your personal information and profit off it at the expense of your privacy. Let us help you take back control of your data, reduce spam, and prevent scam attacks by opting you out of their databases automatically.

App Store download approval required for mobile devices

Elders sometimes have difficulty tracking paid app downloads and the fees associated with them. We set up Family Sharing controls that sends an approval notice you when your family member attempts an app download. We also provide monthly reports of all paid app downloads.

Freeze and Monitor Credit Activity

Freezing credit is a great way to lock out scammers and prevent fraudulent activity on your accounts. We set up alerts when someone tries to open a new credit card and when there's been a large purchase on credit cards.

Who needs DocuPlan?

Seniors and Older Adults

Adult Children Managing Aging Parent’s Affairs

People in Life Transitions

Busy Professionals

High Net Worth Individuals

Small Businesses Owners

Frequent Travelers

People With Disabilities

Individuals Who Lack Time/Skills For Personal Paperwork

Get easy to use tips on keeping your money and data safe:

Set up controls for online purchasing

H2 - Headlinepurchasing

Scrub your data from online databases

fddsfg

Freeze and Monitor Credit

Get alerts when someone tries to open a new credit card. Get notified when there's been a large purchase on credit cards.